What to Expect at Your Tax Attorney Consultation in Alexandria, VA

If you are contemplating a tax attorney consultation in Alexandria, VA, it is vital to know what to expect when meeting with a tax attorney. Whether you need assistance with personal tax issues or business-related tax advice, a professional consultation can help clarify your concerns. John E. Williams, Esq., a seasoned tax attorney based in Alexandria, VA, offers comprehensive guidance, ensuring you are well-prepared and informed throughout the entire process.

Step-by-Step Overview of the Consultation Process with John E. Williams, Esq.

Preparing for a tax attorney consultation with John E. Williams, Esq., involves a well-structured approach that caters to both individuals and businesses. Here is a step-by-step overview of what you can anticipate during your meeting:

Initial Contact and Scheduling

Your first step will be to contact John E. Williams, Esq., through his website or by phone. During this initial communication, you’ll briefly discuss your tax concerns and schedule a convenient time for your consultation. This preliminary interaction helps set the tone for your future meeting, ensuring it is as productive as possible.

During this initial conversation, it’s beneficial to provide a brief outline of your tax issues. Whether it’s an IRS notice, a question about tax deductions, or a concern regarding business tax filings, giving an overview will help in scheduling adequate time for your consultation. John E. Williams, Esq., might ask a few preliminary questions to better understand the complexity of your issues, ensuring you bring along all pertinent documents.

Information Gathering and Document Preparation

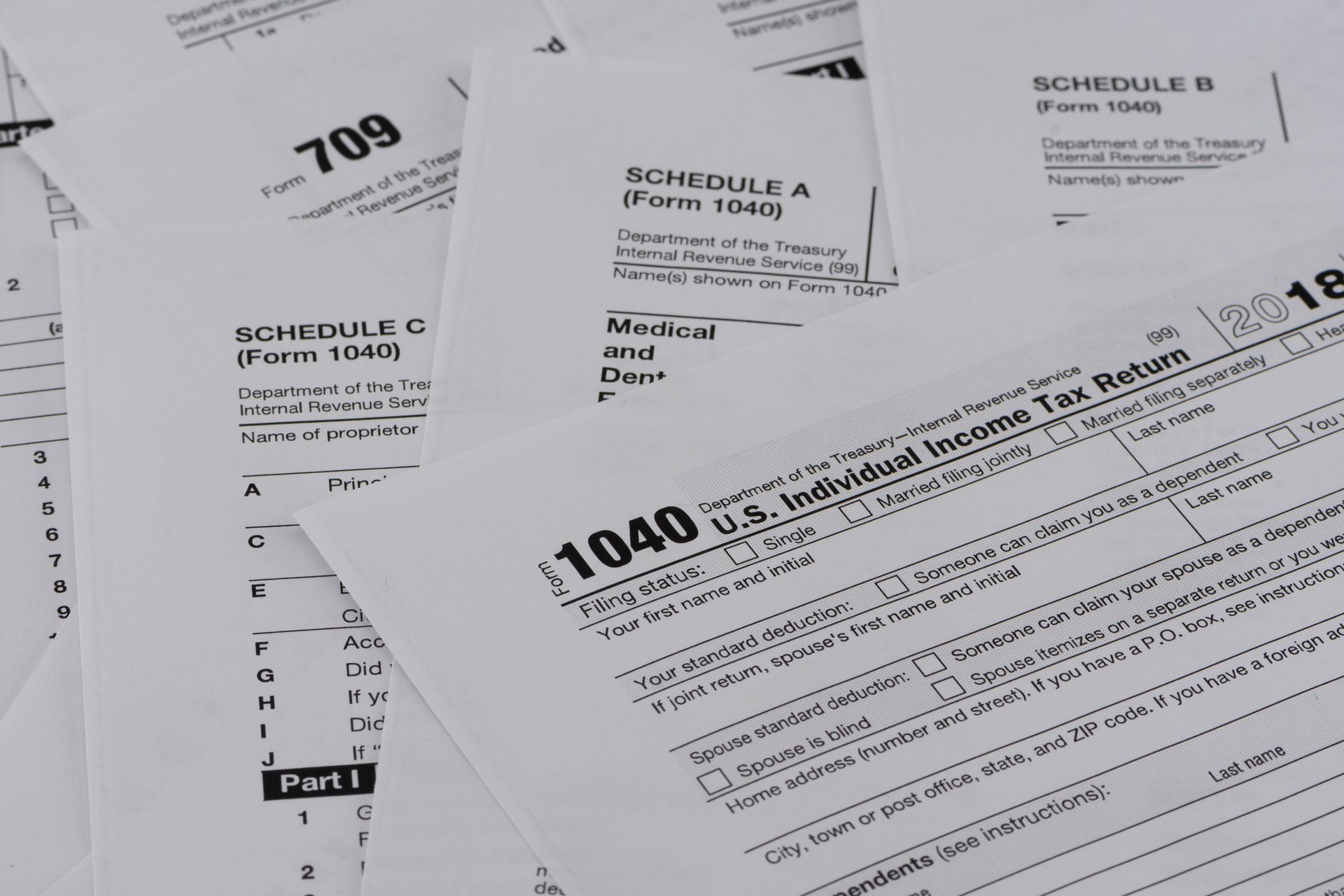

Before your tax attorney consultation, it’s crucial to gather all relevant documents and information. For individuals, this may include previous tax returns, notices from the IRS, and financial records. Business owners should compile business tax filings, payroll records, and documentation related to any tax disputes. Organizing these documents beforehand will streamline the consultation process, allowing John E. Williams, Esq., to provide precise and personalized advice.

Taking time to thoroughly organize your documents is essential. Start by collecting tax records from at least the past three years, including any correspondence with the IRS or state tax authorities. If you have made any mistakes or omissions in your filings, it’s important to pinpoint these areas in advance. For businesses, compile any outstanding invoices and receipts that have implications on your tax filings. The more comprehensive and organized your documents are, the quicker John E. Williams, Esq., can get to the heart of your tax issues and prevent potential delays. For more information on the services provided, visit tax attorney services .

Meeting With John E. Williams, Esq.

On the day of your consultation, expect a thorough review of your tax situation. John E. Williams, Esq., will spend time understanding the details of your case and any specific issues you’re facing. His expertise spans various areas of tax law, ensuring that your concerns are addressed from multiple perspectives. He will discuss potential strategies for resolving your tax challenges, answering any questions you may have along the way.

Developing a Tailored Plan

Following the initial review, John E. Williams, Esq., will create a tailored plan to address your tax issues. This plan may involve negotiating with the IRS, creating a payment plan, or other strategic actions based on your unique situation. His client-focused approach ensures that the plan is both practical and effective, aiming to resolve your issues with minimal stress and confusion.

Importance of Preparing Documents and Information Before Meeting

Walking into a tax attorney consultation well-prepared not only saves time but also enhances the effectiveness of the meeting. The documents you bring play a crucial role in identifying the root of your tax issues and formulating an appropriate response. Prepping your documents allows John E. Williams, Esq., to quickly assess the situation, prioritize key areas, and furnish informed advice.

Make a checklist of essential items such as:

- Previous tax returns (individual or business).

- IRS notices and correspondences.

- Financial statements.

- Payroll records (for businesses).

- Documentation of related disputes.

By having these prepared, you lay a solid foundation for a productive dialogue.

John E. Williams’ Experience and Client-Focused Approach

John E. Williams, Esq., comes with a wealth of experience, having navigated numerous complex tax situations for both individuals and businesses in Alexandria, VA. His background in tax law equips him to handle various scenarios with confidence and precision. Clients often commend his professionalism, attention to detail, and personalized care.

John E. Williams, Esq., emphasizes a client-focused approach, making each client feel valued and understood. He strives to demystify tax law and processes, providing clear explanations and practical solutions. This empathetic approach helps reduce anxiety around tax issues, ensuring clients leave the consultation feeling informed and at ease.

Contact Taxpayers Guardian LLC for Your Consultation

In conclusion, a tax attorney consultation with John E. Williams, Esq., can be an enlightening experience, offering substantial clarity and actionable advice for your tax concerns. Preparing your documents ahead of time, understanding the consultation process, and recognizing John E. Williams’ dedication to client care ensure a seamless and beneficial meeting.

If you are in need of experienced and client-focused tax assistance, do not hesitate to schedule your tax attorney consultation. Contact Taxpayers Guardian LLC today to get started on resolving your tax issues and achieving peace of mind. Optimize your consultation by preparing effectively, and let the expertise of John E. Williams, Esq., guide you through the complexities of tax law.